A 2025 update on the State of Chicago Pensions

You guessed it: our greatest public finance challenge remains a great public finance challenge

As a reminder, we have another City That Works meetup this week! Come join us Thursday, July 17th at the Jefferson Tap, from 5:30-8:30. You can register here (attendance is free).

About two years ago1, I wrote about the state of Chicago pension with an overview of how the city’s four funds were doing at the time. Around this time last year, I was able to update that with the city’s latest Annual Comprehensive Financial Report. The city’s latest report, covering Fiscal Year 2024, came out a couple weeks ago,2 which means it’s time for our annual check-in.

An overview of 2024

As a recap of our starting point: as of the end of 2023 (e.g. last year’s numbers), the combined four pension systems (Police, Fire, Labor, and Municipal Workers) stood at 23.0% funded, with $11.12 billion in assets against $48.32 billion in liabilities (a net unfunded liability of $37.2 billion). My expectation last year was that the net unfunded liability would actually climb in the near-term, even as our funded rates climb, given the latest actuarial reports for the four funds.3

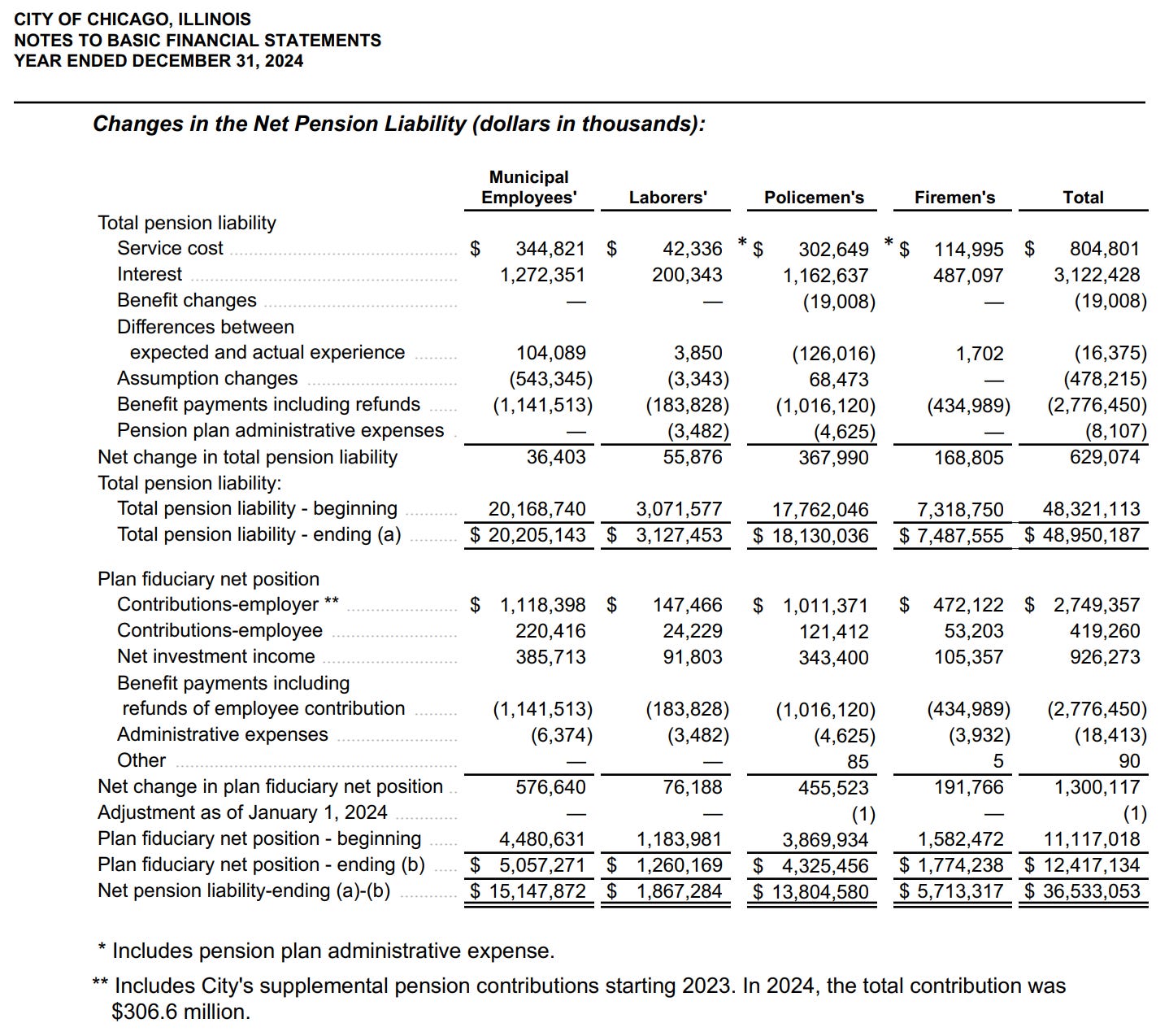

Here’s what actually happened, from the city’s 2024 Annual Comprehensive Financial Report:

Page 101 of the ACFR, for those of you that really like to follow along.

Relatively speaking, things went quite well last year. Fair value of the assets rose by 11.7%, from $11.12 billion to $12.42 billion, with a net investment gain of around 8.3% ($926 million). For three of our four funds (all except Laborers’), contributions outpaced benefits paid, so we are making net progress in growing the asset base from contributions alone.

On the liability side, most things look pretty normal. It’s worth noting that because prevailing interest rates have changed a bit, we now have a higher assumed discount rate for the Municipal, Laborers, and Police fund liabilities, which translates to a lower total liability4. We also have an updated mortality assumption for the police fund, which results in a higher liability for the fund. Those net out to a $478 million reduction in our total pension liability. The other change is a $19 million “benefit reduction” to the Policemen’s fund, which I don’t see any further information on. If I had to guess, I’d assume this is related to the city raising the mandatory retirement age for policemen from 63 to 655, though I’m not positive.

Combining those two: we started the year at $11.12 billion in assets against $48.36 billion in liabilities for a 23.0% funded rate and a $37.2 billion net liability. We ended the year at $12.42 billion in assets against $48.95 billion in liabilities for a 25.4% funded rate and a $36.53 billion net liability6. Making progress!

I especially want to call out the fact that not only did our funded ratio improve, but our net liability actually decreased year over year, as our assets grew by $1.3 billion while our liabilities grew by only $629 million. That’s good.

Mistakes have consequences

One thing I think worth highlighting here is just how explicitly we’re paying for the mistakes of earlier administrations (mostly Daley) not fully funding pensions. We can put a dollar number on this. The four pension funds’ annual reports break out the ‘normal cost,’ which is the amount that our liability increased from active employees accruing another year of benefits. You can think of this as what the city would have to contribute if we had no unfunded liability. For the coming year, our total normal cost across the four funds is around $438 million. Because we’re tremendously underfunded, the city instead is statutorily required to pay roughly $2.6 billion into the funds. That extra $2.2 billion is the cost we’re incurring for the underfunding of the past.

That’s a huge number! Last year’s budget was around $17.3 billion in total, so we’re talking about 12% our budget going just towards digging ourselves out of this hole. The city’s facing a budget gap of over a billion dollars this year, and the bad decisions we made 10-15 years ago are a big reason why. When we talk about the need for good fiscal choices today, and making hard decisions about structural reforms instead of high interest borrowing or wonky structures that postpone hard choices for many years, this is why. Bad choices have consequences for many, many years to come.

Let’s not go backwards

This year’s pension fund outcomes are solid, but to be clear we still have a really long road ahead - our funding rates remain really really low, and our pension amortization plan doesn’t get us back to 90% funded until the late 2050s, when my 6-month-old son will be as old as I am today. There’s not a ton we can do to make that schedule easier, though some ideas - like continuing our supplemental pension payments in every budget cycle - will help.

On the other hand, there are things we can do to make it more difficult. We should not do those things. The most obvious immediate example is H.B. 3657, a bill currently on Governor Pritzker’s desk which would raise both pensionable salaries and cost of living adjustments for Tier 2 retirees in the police and firefighter pension funds. The city’s finance team has estimated that would result in a new $52 million cost in our 2027 budget, and that would only climb over time. The new liability would lower the funded rate of both funds to under 18%. This is a terrible idea, and both the Tribune and the Wall Street Journal have recent editorials calling it out as such. If you don’t like the way they lean, it’s worth noting that the Johnson Administration is also opposed, with city CFO Jill Jaworski testifying as a witness against the bill. Chicago simply can’t afford to go backwards on pensions. Governor Pritzker should veto the bill.

Our returns could have been better (and simpler)

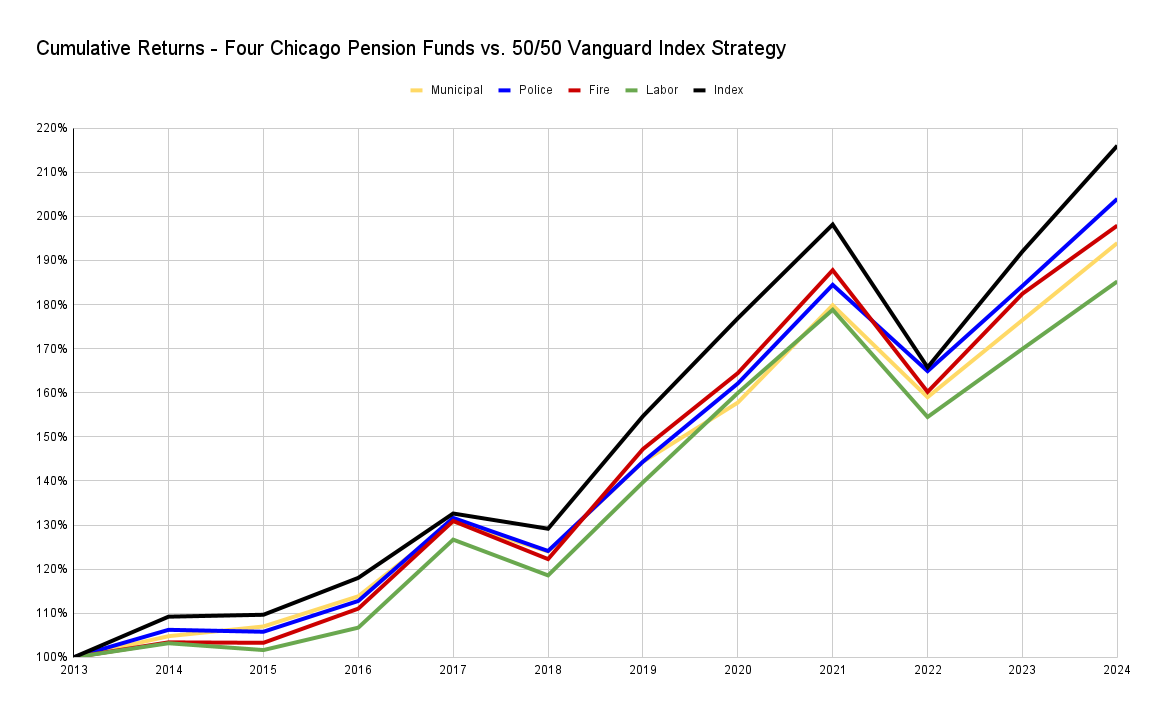

Lastly, I’d be remiss not to make one more pitch for why our pension funds should adopt passive investing. Last August I put together a little exercise to see how Chicago pension funds would have done if we simply used a passive strategy (as some public pension plans, like the State of Nevada, do) instead of allocating funds across eighty-some different investment management firms. The passive approach looked pretty good, saving us $30-40 million per year in management fees without impacting returns (a really basic 50/50 Vanguard strategy outperformed all four funds). I figured I’d update my math to account for 2024 as well.

Last year, the money-weighted rates of return for the Municipal, Police, Fire, and Labor funds were 9.90%, 10.72%, 8.47% and 9.00%, respectively, per the funds’ individual ACFRs. If you instead deployed a passive strategy, putting 50% of funds into Vanguard’s total stock market and total bond market funds, you would have instead generated a 12.49% return for the year. That remains better - and simpler - than the active approach that the four funds actually took, even before accounting for the lower management fees this would save or the increased liquidity it would allow the funds to maintain. I remain convinced this is a good idea.

The Bottom Line

As you may have guessed, pension debt is still very much a big deal. We still have quite a bit of it, our system remains poorly funded overall, and dealing with this reality remains our greatest fiscal challenge as a city. It’s imperative that we continue to deal with this reality in our annual budget, while avoiding making the problem worse and growing those liabilities more than is necessary.

Sheesh, have I really been doing this for more than two years?

You can read the Tribune’s coverage here for a broader, non-pension specific overview, though I don’t love their pension coverage (see more in footnote 6!)

Our total pension liability is a present value discounting calculation - we estimate the amount the funds need to pay out every year in the future, and discount it back using some interest rate to get today’s liability. When rates go up, we discount it using a higher interest rate, so the present value of the liability becomes lower.

The police fund’s 2024 valuation report states (see page 10 - “Changes in Provisions of the Fund”) that this change decreased the actuarial liability for 2024 by $18.8 million, which seems pretty close to that $19 million figure.

One random note: I noticed the Chicago Tribune reference the city’s latest unfunded liability as $35.8 billion for 2024, down from $37.2 billion in 2023. This is incorrect, and it’s conflating two sets of figures. The thing to note is that pension assets can either be valued using ‘fair value,’ which is their best estimate of the actual market value of the assets, or using ‘actuarial value.’ Actuarial value allows plans to smooth out any excess or shortfall in the plans’ returns over several years, to reduce year-to-year volatility in the valuation of the assets.

If you use the city’s 2023 and 2024 ACFRs, which report net pension liability using the fair market value of the plans’ assets, our unfunded liability declined from $37.2 billion to $36.5 billion year-over-year. If you instead use the plans’ actuarial values of the plans’s assets, our unfunded liability increased from $35.5 billion to $35.8 billion year-over-year.

I think it’s probably better to use market value, since that’s more grounded in reality of where we are today, but I think reporting either set of numbers is justifiable - but it’s definitely not in any way correct to use the two interchangeably when comparing two different years.

The passive investing, which generally works equally well for personal investing including 401ks, almost always outperforms active managers. I suppose some small allocation might be made to private equity funds or alternative investments but those seem like a political 3rd rail to me and come with plenty of risk.

To me, it looks like the active managers are part of the stationary bandits that weigh Chicago down so very much.

Keep it up!

Talking about following this stuff for 2 years, I've been ragging on Chicago pensions since about 2008/2009. ;)

But it does build up over time, just as the contributions they didn't make starting 20+ years ago.

Everybody does try to get around having to make higher contributions, but alas, using anything less than a 100% target, and continuing to use iffy valuation assumptions means... yeah, they're almost definitely going to have to make higher contributions than currently scheduled. Even before those police/fire pension sweeteners.