A 2024 update on the State of Chicago Pensions

Our greatest public finance challenge remains a great public finance challenge

About a year ago, I wrote about the State of Chicago Pensions with an overview of how each of the city’s four funds was doing at the time. The city’s latest annual financial report came out recently (you can read the Tribune’s coverage here), and I thought that presented a good opportunity for an update on how we’re doing.

As you might imagine, we are not doing great. You certainly get that impression from the Tribune’s and other news coverage, but as is too often the case in public finance coverage, the big lead in most of the news coverage is how our pension debt is a big number - over $37 billion! That’s a lot! That’s true, but it was a lot last year too - which is why I don’t think focusing on the big headline number is necessarily all that constructive. Today I wanted to dive a bit deeper on what’s driving that figure and exactly how our pension liabilities are evolving compared to expectations.

As a starting point: when I wrote about pensions last June, the combined four pension systems (Police, Fire, Labor, and Municipal Workers) stood at 23.8% funded, with $10.39 billion in assets against $43.64 billion in liabilities (a net unfunded liability of $33.25 billion). That figure was based on the latest data available (December 31, 2021) from Boston College’s Center for Retirement Research. I’m switching to using Chicago’s and the funds’ estimates this time around, for reasons I’ll note here in a footnote.1 Note that if I use the city’s December 31, 2021 figure instead of the CRR’s, the four funds had $10.96 billion in assets against $44.65 billion in liabilities for a 24.5% funded rate and $33.70 billion in net liabilities.

As of the end of 2023, things got worse. The latest report shows the four funds at $11.12 billion in assets (up 1.5%) against $48.32 billion liabilities (up 8.2%) for a net 23.0% funded rate and the $37.2 billion unfunded pension liability you can see in the news. That’s not good! Here’s how we got there.

2022 was really bad

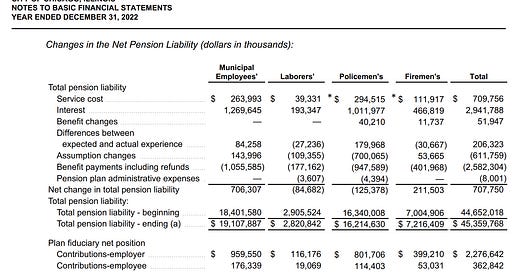

From the city’s 2022 Annual Comprehensive Financial Report:

2022 was just a really bad year for the funds. Given that the funds are supposed to return somewhere in the ballpark of 7% per year, and the S&P was down nearly 20%, its worst return since 2008, that basically tracks. Fair value of the assets fell by around 9.4%, from $10.96 billion to $9.92 billion, with a net investment loss of nearly 10%. I also think it’s worth noting that for three of the four funds (Police, Fire, and Labor), benefit payments out of the funds actually outpaced total contributions into the funds - so (ignoring intra-year timing of contributions/payments) we had no net contributions to invest long-term. That’s not healthy! You can’t rely on investments to pay beneficiaries if you’re not able to make any investments in the first place. For the Municipal fund (which you may recall is also the best funded fund), contributions did outpace benefits paid, but only by about $80 million.

On the liabilities side, most of everything looks like pretty ‘business as usual’ activity, but it’s worth noting that an increase in interest rates led to a higher assumed discount rate for our Police and Labor fund liabilities. This lowered the total fund liability by around $600 million overall. Despite that, the city had an increase of around $700 million for the funds. About half of that ($360mm) is just the interest cost2 less the year’s benefit payments. The total service cost - the new liabilities accrued this year for additional service time for current employees - also made up over $700 million in costs for the year. We have about 55,000 employees across these four plans, so that’s $12-13k accrued in incremental benefits this year for every employee in the system. That strikes me as somewhat high, but I’m not sure there’s anything we can do about it given constitutional protections.

Combining those two things: we started the year at $10.96 billion in assets against $44.65 billion in liabilities for a 24.5% funded rate and a $33.7 billion net pension liability. We ended the year at $9.92 billion in assets against $45.36 billion in liabilities for a 21.9% funded rate and a $35.4 billion net pension liability. Not great!

2023 was somewhat better

From the city’s 2023 Annual Comprehensive Financial Report:

2023 was a much better year. Net investment income was just over 9%, returning $904 million on $9.92 billion in assets. Contributions also outweighed benefits paid for three of the four funds (all except Labor), with $2.992 billion in contributions3 versus $2.684 billion in benefits paid, leading to a net $1.19 billion increase in the total value of the assets.

Two things are worth noting on the liabilities side. First, reversing the assumption change for 2022, lower municipal interest rates in 2023 led to a lower assumed discount rate for our Municipal, Labor, and Police funds, which results in a higher PV of our total future liabilities (this increased liabilities by $642 million in total). Second, in November 2023 Springfield passed a bill which raised Chicago police officers’ annual cost of living adjustment from 1.5% to 3.0%. That benefit hike results in higher future liabilities. While the 2024 budgetary impact of the change was estimated by the Johnson administration to be around $60 million, our pension accounting recognizes the entire lifetime impact of the change, which is estimated to be $1.06 billion.

Combining the two: we started the year at $9.92 billion in assets against $45.36 billion in liabilities for a 21.9% funded rate and a $35.4 billion net pension liability. We ended the year at $11.12 billion in assets against $48.32 billion in liabilities for a 23.0% funded rate and a $37.2 billion net pension liability. An extra $2 billion in debt is obviously never a good thing - but an increase in our (admittedly still terrible) funded rate is still a good sign.

Looking forward, it’s worth noting that even assuming we receive solid investment returns and continue to make our required contributions, our net pension liability is likely to rise in the near-term, even as our funded rates climb. The latest actuarial reports for the Muni, Labor, Police and Fire funds show net unfunded liabilities peaking in 2036 (page 63), 2034 (page 34), 2029 (page 31), and 2026 (page 70), respectively - it’s not until after those points when our asset growth actually exceeds liability growth in absolute dollar terms, not just percentage terms.

The Bottom Line

Pension debt is, in fact, still very much a big deal. We have quite a bit of it, our system remains poorly funded, and dealing with this reality remains our greatest fiscal challenge as a city. It’s imperative that we continue to seek out solutions on the revenue side - while also avoiding future problems (like needlessly large benefit increases) which can cause those liabilities to grow even further.

First - Chicago and the funds produce estimates on a more timely basis than the Center for Retirement Research. As of now, the CRR only has figures for 2022, while the city reported 2023 figures already (which is what the Tribune is citing).

Second, the city and the funds are reporting both the fair value of the assets and the actuarial value of the assets, while the BC data reported only actuarial value. I’d prefer to use fair value estimates here. ‘Fair value’ is basically the market value of the plan’s assets - what they’re really worth today. ‘Actuarial value’ adjusts market value to smooth out short-term market fluctuations, so any gains or losses that differ from the plan’s projected return are spread out over 3-5 years. For the avoidance of doubt, that’s not anything nefarious; it’s a common practice for all public pension funds, but I think it’s more useful to see where we actually stand today.

The total pension liability is a present value discounting calculation - this ‘interest’ line is basically rolling that PV calculation forward by one year (so we discount less than we did last year).

Although please also note that this includes our $242 million supplemental pension payment in the 2023 budget; without that, we’re much closer to breakeven on contributions versus benefits paid.